Wage and hour overtime calculation

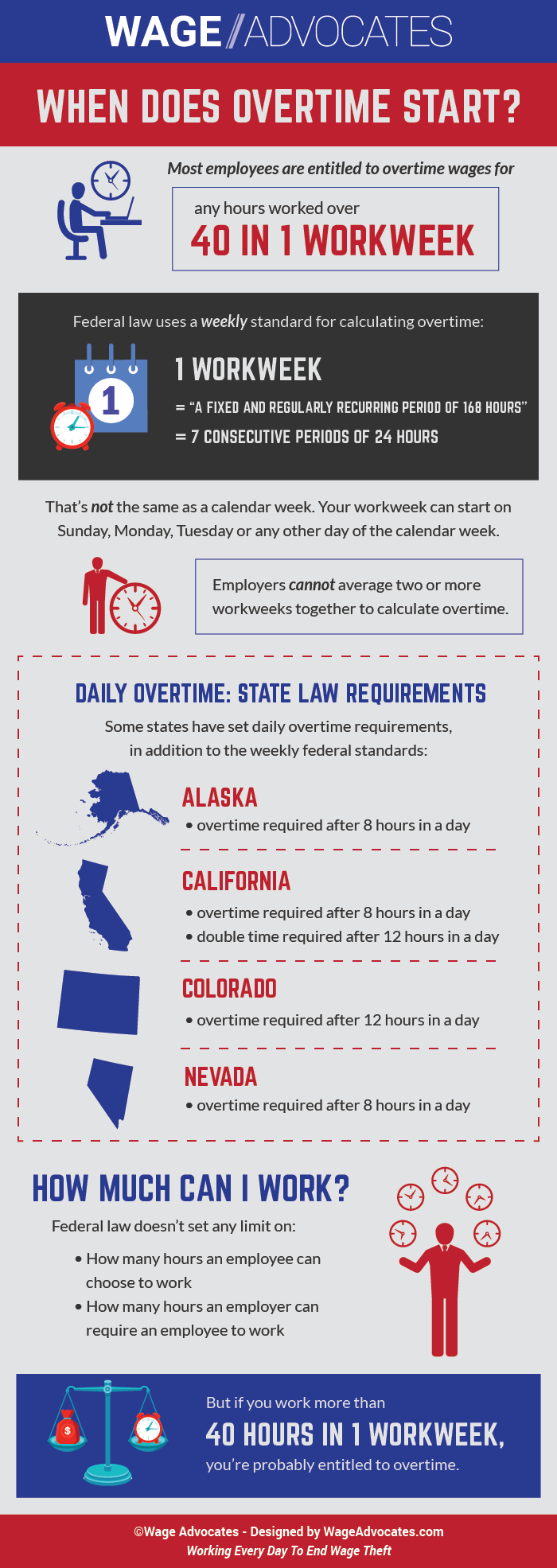

The FLSA requires that covered nonexempt employees in the United States be paid at least the Federal minimum wage for all hours worked and receive overtime pay at one and one-half. The federal overtime provisions are contained in the Fair Labor Standards Act FLSA.

How To Calculate Overtime Pay A Short Guide Timecamp

The weekly earnings estimate of 29000 is based on a standard 40-hour workweek.

. The 75 hours were subtracted from the 615 hours worked leaving 54 hours that week. The amount of money you are paid each hour before tax. The key word here is worked Holiday pay is not considered.

1200 40 hours 30 regular rate of pay. The yearly earnings estimate of 1508000 is based on 52 standard 40-hour work weeks. Federal wage and hour law requires that overtime is paid to non-exempt employees for all hours worked over 40 in a workweek.

Note that tips are not included in the regular rate for overtime calculation purposes. Coverage and Employment Status Advisor helps identify which. 10 regular rate of pay x 5 x 10 overtime hours 50.

Unless exempt employees covered by the Act must receive overtime pay for hours worked over 40 in. Of overtime hours Overtime rate per hour. -Total gross pay.

Payroll So Easy You Can Set It Up Run It Yourself. Ad Compare This Years Top 5 Free Payroll Software. 50 hours total minus 40 regular hours equals.

The overtime calculator uses the following formulae. Get Your Quote Today with SurePayroll. The employee works 50-hours in the workweek with 10 hours of overtime owed under the 40-hour.

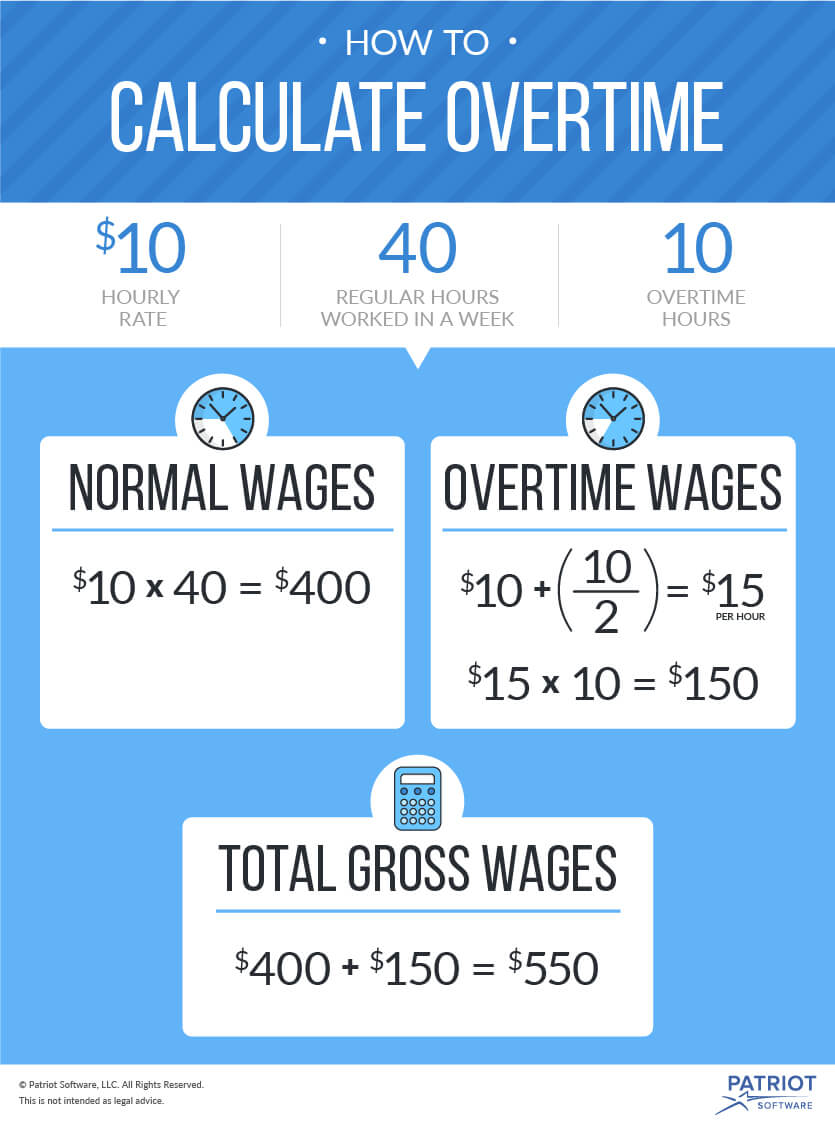

Ad Paycors All-In-One HR Solution Streamlines Every Aspect Of Your Organization. Take a Guided Tour Today. The basic overtime formula is Hourly Rate Overtime Multiplier Number of Overtime Hours worked in a particular week.

The Hourly Wage Tax Calculator uses tax information from. Enter the number of hours you work each week excluding. A financial advisor in Pennsylvania can help you understand how taxes fit into your overall financial goals.

Value of the top ten wage and hour settlements in 2009 which totaled 3636 million as compared to only 253 million in 2008. 30 x 15 45 overtime. The employees total pay due including the overtime premium for the workweek can be calculated as follows.

Only the payment of. All Services Backed by Tax Guarantee. -Overtime gross pay No.

Since straight-time earnings have already been calculated see Step 1 the additional. Of these 54 hours 14 were. The most prevalent wage and hour cases are.

Ad Configurable Time Tracking Approvals Alerts ProjectJob Rates. Overtime pay is often more than the regular hourly rate too. Overtime Calculator Usage Instructions.

A common rule is that overtime pay must be 15 times the regular rate of paycommonly called time and a half. For an employer to take a tip credit for an employees base hourly wage the employee must earn at least 135 in tips per month. See How Paycor Fits Your Business.

10 hours of overtime. Employers are required to ensure that the base hourly wage. Financial advisors can also help with investing and financial planning -.

Overtime on a flat sum bonus must then be paid at 15 times or 2 times this regular rate calculation for any overtime hour worked in the bonus-earning period. 820hour times 5 half the regular rate equals. Free Unbiased Reviews Top Picks.

410 per week or 820 per hour worked 41050. Elaws FLSA Advisor addresses key wage and hour topics including overtime pay requirements. Calculating overtime pay rate.

Ad Get Started Today with 1 Month Free. There were 75 hours of daily PWR overtime earned from June 29-31. The algorithm behind this hourly paycheck calculator applies the formulas explained below.

Enter your normal houlry rate how many hours hou work each pay period your overtime multiplier overtime hours worked and tax rate.

Fact Sheet 54 The Health Care Industry And Calculating Overtime Pay U S Department Of Labor

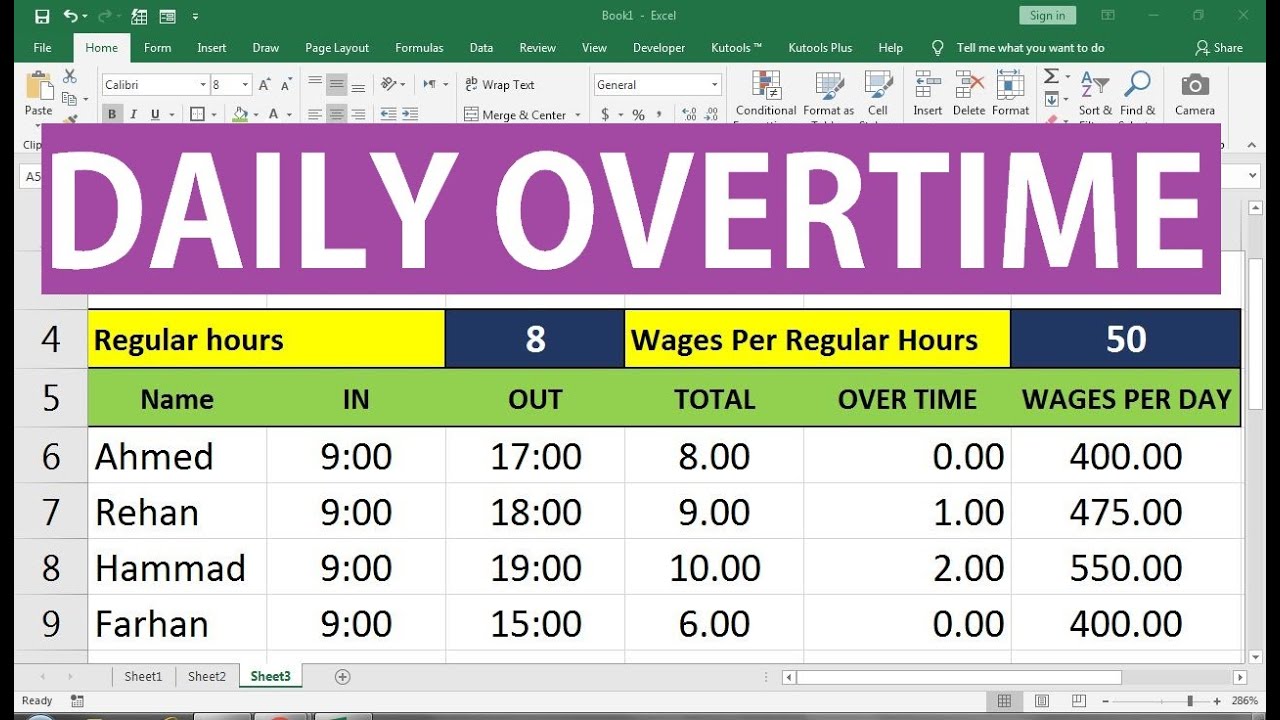

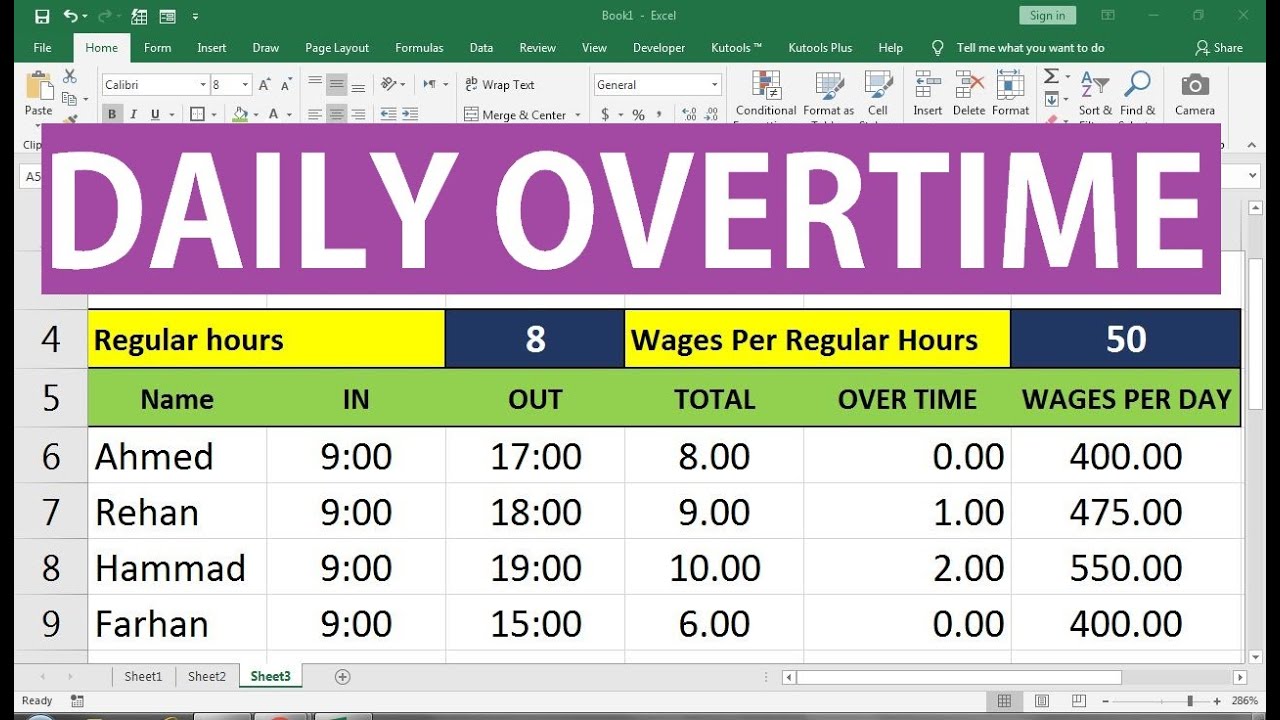

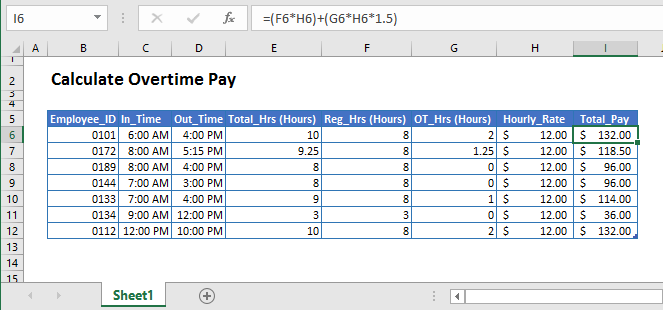

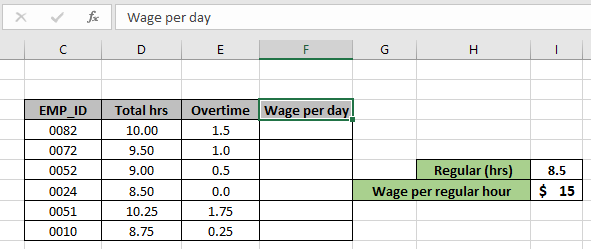

Calculate Overtime In Excel Google Sheets Automate Excel

Excel Formula Basic Overtime Calculation Formula

Overtime Pay Calculators

Overtime Pitfalls That Could Cost You Daily Infographic Infographic Business Infographic Learn Something New Everyday

Overtime Calculation Formula In Excel Youtube

Overtime Pay Calculators

Overtime Calculator

Overtime Calculator To Calculate Time And A Half Rate And More

Overtime Pay Calculators

When Does Overtime Start Wage Hour Violation Lawsuit

How To Calculate Overtime Pay Easy Overtime Calculator A Basic Guide

Calculate Overtime In Excel Google Sheets Automate Excel

Overtime Pay Laws Every Small Business Owner Must Know

How To Quickly Calculate The Overtime And Payment In Excel

Free Printable Employment Contract Sample Form Generic Sample In Overtime Agreement Template 10 Prof Nanny Contract Template Contract Jobs Contract Template

Calculate Overtime Amount Using Excel Formula